My method for paying bills on time – every time

My method for paying bills on time – every time

My method for paying bills on time – every time

How many bills do you pay each month? How do you make sure you pay them all on time? It is normal to have over a dozen bills to keep track of monthly. Paying your bills on time and regularly is the key to improving your credit score. Here is what I do to make sure that I pay all my bills on time – every time.

- Make a List. Make a list of all your bills, the amount due and the due date each month. Due dates can fluctuate a bit each month – for example, your water bill may be due on the 8th some months, and as late as the 11th in other months. Put the earliest date on your list to avoid paying it late by accident.

- Check Your List. Refer to that list at the same time once or twice each month to plan out your bill payments for that period. I find that I need to go through this process twice a month, since a couple of my bills are not available yet when I pay bills early in the month.

- Don’t rely on a paper bill or an email notification to remind you to make a payment. Paper mail can get delayed, and an email message may not reach your inbox. Instead, go through your listing of bills that will be due later in the month, and make a plan for the payment of each one.

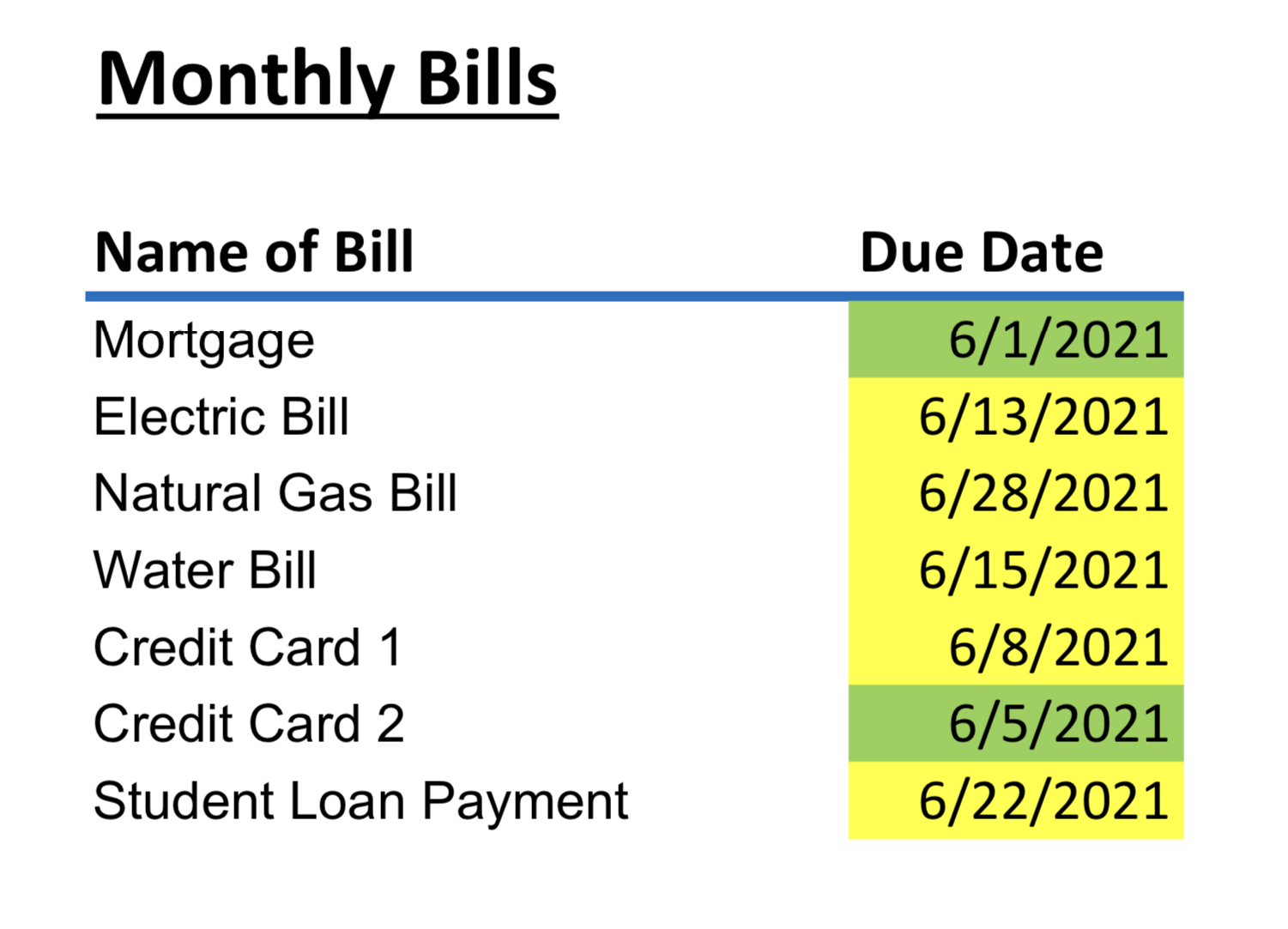

- Online Bill Pay. Online banking is ideal for this task. You can schedule each of your bill payments in advance once you have determined the exact amount due for each bill. I keep my list of bills in a spreadsheet, and I highlight each one in green once I pay it. Below is a picture of what a spreadsheet might look like. Try my template out, by opening in Google Sheets, selecting “File,” then “Make a copy.” Monthly Bills Template.

- Automatic Payments. For bills that are the exact same amount every month – like a mortgage or student loan payment – consider setting up an automatic monthly payment. Just make sure that you have the right amount in your bank account on the day the payment is scheduled.

- Include Additional Bills. Be sure to include irregular expenses – these are bills that are not due every month. For example, auto insurance is often billed every six months, and homeowner’s or renter’s insurance is typically paid annually. Compile a list of these bills and keep track of them on your calendar. Also consider putting a month’s worth toward that bill in your savings account each month so the money will already be there when it is due to be paid.

Durham Tech Community, for more personal finance advice or tips, email me at chapmanl@durhamtech.edu

Larry is the Financial Coach at Durham Tech, providing individual coaching services and information to the students and employees of the Durham Tech community.